dci case study

Revitalizing the U.S. banking system

The DCI Challenge

DCI set itself a significant goal: to improve the structure of one of its most important core solutions, core banking, by incorporating the latest UX practices.

The successful outcomes of this initiative sparked a continuous stream of extensive partnerships between Luby and DCI. These collaborations range from the ground-up design of new fintech solutions to the revitalization of their core applications.

The successful outcomes of this initiative sparked a continuous stream of extensive partnerships between Luby and DCI. These collaborations range from the ground-up design of new fintech solutions to the revitalization of their core applications.

The Luby solutions integrated into this project:

CustomerX

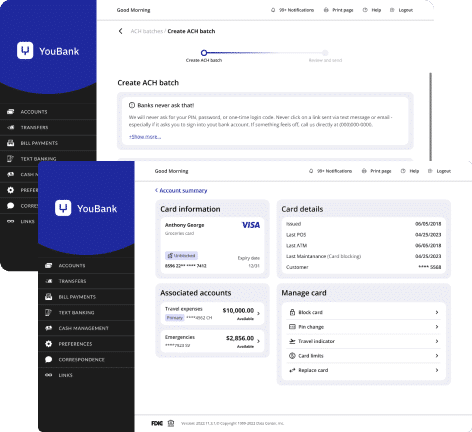

Project: GoBanking

Luby took on the challenge of redesigning DCI’s entire online bank, a solution that combines different products to serve the more than 200 community banks connected to it.

Its main challenge was to improve the usability of an already consolidated and robust platform, modernizing its customers’ interaction with it, without losing its essence and functionalities.

For this mission, our work was divided into different phases:

From this, we were able to prioritize our deliveries and have already redesigned some of the main interfaces and experiences that add value for users. Finally, we are working on improving the Cash Management section (batch payments)

Luby took on the challenge of redesigning DCI’s entire online bank, a solution that combines different products to serve the more than 200 community banks connected to it.

Its main challenge was to improve the usability of an already consolidated and robust platform, modernizing its customers’ interaction with it, without losing its essence and functionalities.

For this mission, our work was divided into different phases:

- Exploratory research with the banks.

- Mapping of the entire system (its functionalities, components, interface, bank configurations, clients and available customizations).

- Desk Research to understand the characteristics and specificities of community banks and their customers.

- Benchmarking with direct and indirect competitors to better understand their offers, interfaces and experiences.

- Redesign of system screens and flows.

From this, we were able to prioritize our deliveries and have already redesigned some of the main interfaces and experiences that add value for users. Finally, we are working on improving the Cash Management section (batch payments)

Banking Evolution

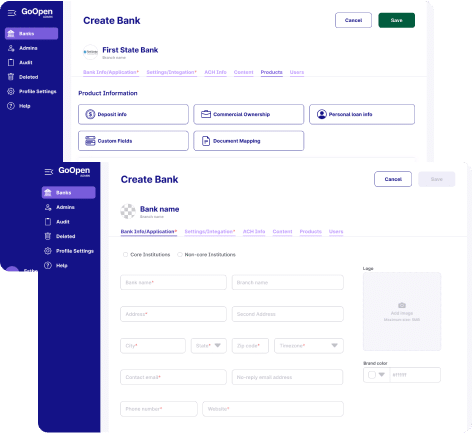

Project: GoOpen

Our Banking Evolution solution focuses on the evolution of banking systems and has helped DCI refactor the account opening module of its system. The challenge is to solve the system’s problems and transform it into a modern and functional environment. Our team of experts consists of Designers, Product Managers, Teach Leads, Architects and Developers. To transform the system into something scalable and more connectable, our work included some initial actions such as:

Our Banking Evolution solution focuses on the evolution of banking systems and has helped DCI refactor the account opening module of its system. The challenge is to solve the system’s problems and transform it into a modern and functional environment. Our team of experts consists of Designers, Product Managers, Teach Leads, Architects and Developers. To transform the system into something scalable and more connectable, our work included some initial actions such as:

- Analysis of the system. Benchmarking with ten competitors.

- Walking through all the steps in the new account opening process.

- Interviewing DCI employees.

- Performing a heuristic analysis of the administrative system to find features that could be improved.

The results of this

strategic partnership:

39% savings on total project value compared to a US supplier.

25% savings on the total value of the project compared to a supplier in Kansas (where the client is headquartered).

Wondering how Luby can benefit your business? Connect with our specialists to gain valuable insights.

Client Review

“Since Luby Software joined the project, we have seen significant improvements and progress in the initiative. Project management has proven to be very effective through communication via email, Microsoft Teams and other tools. In general, the team is characterized by open communication and a proactive attitude.

This is a very solid company with great ambitions.”

This is a very solid company with great ambitions.”

Daren Fankhauser (CTO)

Skill Set

Front-end Development

Back-end Development

Project Managment

Quality Assurance

UX Research

UI Design

Tech & Stack

About the company

DCI is a leading developer of Fintech, core processing, and digital banking solutions.

With nearly 60 years of experience, DCI is a leader in developing banking technology and services for community banks throughout the North American market.

Start Accelerating your Digital Roadmap Today!

Just fill in this form our call us at +1 (305) 600 1993

Technology Intelligence

Luby - North America

1110 Brickell Avenue

Suite 310

Miami – FL

United States

Phone:

Email:

Luby - Latin America

Rua Amália de Noronha, nº 151, 3º Andar, Sala 303

Pinheiros, São Paulo – SP – Brasil

CEP: 05410-010

Pinheiros, São Paulo – SP – Brasil

CEP: 05410-010

Phone:

Email:

Copyright ©2023 Luby Software LLC. All rights reserved.