cartos case study

Becoming a benchmark in banking as a service

The Cartos Challenge

Cartos’ main objective is to promote the democratization and expansion of access to credit, providing high quality services in all aspects of financial operations. In partnership with Luby, it has played a crucial role in the creation and implementation of new banking as a service financial solutions for the bank.

The Luby solutions integrated into this project:

Financial Innovation

Our first challenge was to assess the application and rebuild it from the ground up based on the issues identified. With a well-defined roadmap for the hybrid application, we organized our operation into four multi-disciplinary teams consisting of back-end, front-end and mobile developers, QAs, POs, Scrum Master, Solution Architect and UX/UI designers.

We started development by working on the architecture of the solution, with the client’s premise being a scalable application with high availability, fault tolerance, and low infrastructure maintenance. We decided to develop a microservices architecture and use AWS Serverless.

In this first version of the application, we also achieved:

We started development by working on the architecture of the solution, with the client’s premise being a scalable application with high availability, fault tolerance, and low infrastructure maintenance. We decided to develop a microservices architecture and use AWS Serverless.

In this first version of the application, we also achieved:

- Integration with SPB (Brazilian Payment System).

- Integration with SPI (Instant Payment System).

- Integration with PSTI (Information Technology Service Providers).

- In addition, the application initially included the basic structure of Internet Banking for essential operations.

Banking Evolution

Digital Account Project

With the initial release validated and a solid roadmap for new features, we worked with Cartos to evolve their core banking system, helping to organize and prioritize the project backlog. Several key integrations were required at this stage, such as

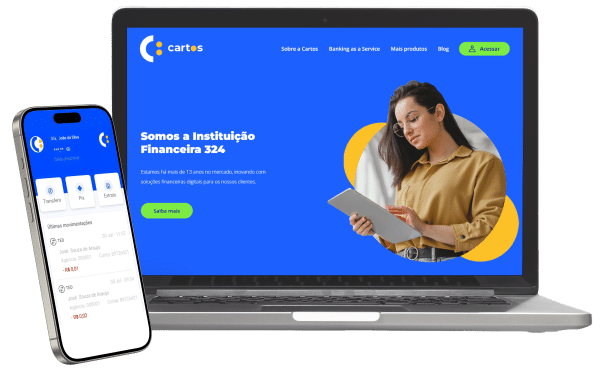

We also developed the Banking as a Service project, a milestone in the bank’s history. With a team specialized in the financial sector, we provided Cartos with all the APIs for both digital accounts and CCB issuance, along with a back-office platform designed specifically for operational control.

Cartos’ Banking as a Service is aimed at lenders, such as corporates, fintechs and bank correspondents, as well as the capital market, including FIDCs, securitization companies and assets.

With the initial release validated and a solid roadmap for new features, we worked with Cartos to evolve their core banking system, helping to organize and prioritize the project backlog. Several key integrations were required at this stage, such as

- Integration with CADOC (Central Bank of Brazil’s Document Catalog).

- Integration with CCS (Customer Registry of the National Financial System).

- Integration with NPC (New Billing Platform) for the generation, issuance and payment of bank slips.

- Over time, new features were developed, including batch transaction remittance and fee control.

We also developed the Banking as a Service project, a milestone in the bank’s history. With a team specialized in the financial sector, we provided Cartos with all the APIs for both digital accounts and CCB issuance, along with a back-office platform designed specifically for operational control.

Cartos’ Banking as a Service is aimed at lenders, such as corporates, fintechs and bank correspondents, as well as the capital market, including FIDCs, securitization companies and assets.

Cybersecurity

Our team also led cybersecurity projects for the bank. We enabled KYC (Know Your Customer) tools through integration with five technologies and assisted in establishing the security action flow.

In partnership with Cartos and Luby, a payment gateway was developed and integrated with a security and anti-fraud tool.

In partnership with Cartos and Luby, a payment gateway was developed and integrated with a security and anti-fraud tool.

Payment solutions

As briefly mentioned above, a payment gateway was developed, providing inventory control and order history. Payment solutions for e-commerce have been integrated: Pagseguro and Movingpay.

Our team, with strong expertise in payment development integration, delivered the project quickly and securely, allowing Cartos to begin operations on the Merchant Dashboard project.

Our team, with strong expertise in payment development integration, delivered the project quickly and securely, allowing Cartos to begin operations on the Merchant Dashboard project.

Finance Outsourcing

For all solutions resulting from the partnership with Luby, Cartos also relies on two support teams responsible for improving processes, features and necessary adjustments. Composed of ten professionals, including PO, Solution Architect, QAs and developers, these teams provide support for existing applications, while other teams address new requirements and technological advancements for Cartos.

The results of this

strategic partnership:

2 billion in newtransactions

60 thousand +1200 digital accounts

16 new products on the platform

70 thousand CCBs issued

30% thousand monthly increase in operations without increasing the number of employees

More than 20 times increase in the number of new custom per month.

Curious about how Luby can benefit your company? Engage with our experts and gain insights.

Client Review

“We hired Luby for their ability to deliver work with scalability. They train developers to scale programming with specialized management.”

Yim Kyu Lee (CTO & CPO)

Skill Set

Front-end Development

Back-end Development

Mobile Development

Microsservices

Tech & Stack

About the company

Cartos is a financial institution and fintech with a 13-year history in the Brazilian market. It is an innovative company that constantly strives to digitally improve its products and provide the market with technological, secure and intuitive solutions.

Start Accelerating your Digital Roadmap Today!

Just fill in this form our call us at +1 (305) 600 1993

Technology Intelligence

Luby - North America

1110 Brickell Avenue

Suite 310

Miami – FL

United States

Phone:

Email:

Luby - Latin America

Rua Amália de Noronha, nº 151, 3º Andar, Sala 303

Pinheiros, São Paulo – SP – Brasil

CEP: 05410-010

Pinheiros, São Paulo – SP – Brasil

CEP: 05410-010

Phone:

Email:

Copyright ©2023 Luby Software LLC. All rights reserved.