tiba case study

Revolutionizing the financial landscape for retail businesses

The Tiba Challenge

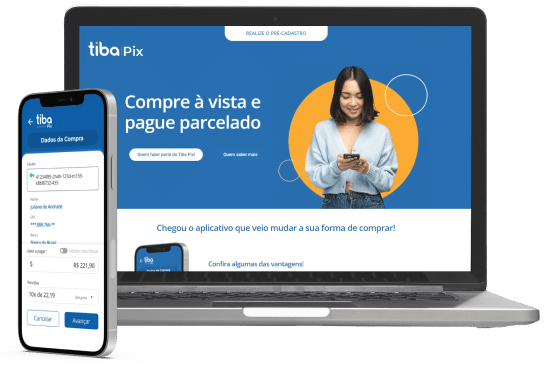

Tiba had a latent desire to innovate the financial sector for retail businesses. Looking for a strategic technology partner, the company set out to develop its first application focused on the Buy Now Pay Later payment model via Pix (instant electronic payment).

Embracing the Buy Now Pay Later business model, Tiba dedicated itself to developing PIX solutions, building expertise in the most widely used payment method in Brazil.

Embracing the Buy Now Pay Later business model, Tiba dedicated itself to developing PIX solutions, building expertise in the most widely used payment method in Brazil.

The Luby solutions integrated into this project:

Finance Innovation

As part of our commitment to the Product Market Team, we organized our team into three distinct teams to develop a hybrid mobile application. This application aimed to provide Tiba’s customers with a secure platform for Pix-based payments and receipts. Our multidisciplinary team consisted of various roles, including backend developers, frontend developers, mobile developers, QAs, solution architects, and product owners.

While the product roadmap initially suggested a development timeline of approximately 8 months, the agility and dedication of our team enabled us to deliver the first version of the application in just 3 months.

At the same time, we worked to build a web-based back-office platform that included onboarding processes, customer journey tracking, invoice management, and credit approval controls. This solution played a key role in enabling Tiba to provide more accurate management capabilities to its customers.

While the product roadmap initially suggested a development timeline of approximately 8 months, the agility and dedication of our team enabled us to deliver the first version of the application in just 3 months.

At the same time, we worked to build a web-based back-office platform that included onboarding processes, customer journey tracking, invoice management, and credit approval controls. This solution played a key role in enabling Tiba to provide more accurate management capabilities to its customers.

Banking Evolution

Once the initial solution was validated in the market, we continued to evolve the product, developing new features and integrations to increase operational robustness. Various functionalities were introduced on several fronts. Here are a few examples:

- Face ID enablement: Implementation of Face ID for easy application access.

- MGM Model Implementation: Introduced the Member Get Member (MGM) model, where users receive rewards for referring new customers and these rewards can be used for payments.

- Pix Empresa architecture and development: Design and development of Pix Empresa, a rebate system for Pix payments, specifically tailored for Tiba’s partner companies.

CyberSafe

As part of our commitment to prevent system fraud, we have implemented Know Your Customer (KYC) tools by integrating with anti-fraud technologies and helping to set up security protocols. First, we integrated with Zaig, which is responsible for identifying potential fraud through data analysis. We then integrated Tiba with Unico.

The Unico Check solution, which specializes in identity authentication and liveness detection, not only improved application security, but also accelerated the digital validation of users. With a focus on improving security for both the user and the application itself, we continued to evolve:

The Unico Check solution, which specializes in identity authentication and liveness detection, not only improved application security, but also accelerated the digital validation of users. With a focus on improving security for both the user and the application itself, we continued to evolve:

- Biometric token for data validation: Implementation of a biometric token for data verification.

- Transactional Password: Introduced a transactional password for added security.

- Device Validation: Implemented a device validation process.

CustomerX

In this regard, our deep understanding of the persona of a financial institution enabled us to implement actions and functionalities that optimize user engagement.

We initiated the integration of the application with WhatsApp using the Twilio tool, initially used in the first version of the application for notifications. As the product evolved, so did this feature, leading to the development of a bot that facilitated the implementation of the customer onboarding process through WhatsApp.

Through this bot, we seamlessly integrated the customer onboarding flow with credit scoring and demographic tools. This made the customer enrollment process intuitive, easy, and secure, creating a connected and efficient experience for users.

We initiated the integration of the application with WhatsApp using the Twilio tool, initially used in the first version of the application for notifications. As the product evolved, so did this feature, leading to the development of a bot that facilitated the implementation of the customer onboarding process through WhatsApp.

Through this bot, we seamlessly integrated the customer onboarding flow with credit scoring and demographic tools. This made the customer enrollment process intuitive, easy, and secure, creating a connected and efficient experience for users.

Finance Outsourcing

Tiba also has a highly qualified, multidisciplinary support team responsible for maintaining its Software as a Service (SaaS) system. Tiba’s SaaS is a comprehensive Enterprise Resource Planning (ERP) solution that represents the company’s first product, developed several years ago and marking its entry into the market.

Despite the changes in their business over the past year, this SaaS software remains robust and strategic, playing a critical role in their operations and requiring ongoing support. Encouraged by the success of Luby’s other solutions, Tiba subsequently engaged us in additional areas of collaboration.

Despite the changes in their business over the past year, this SaaS software remains robust and strategic, playing a critical role in their operations and requiring ongoing support. Encouraged by the success of Luby’s other solutions, Tiba subsequently engaged us in additional areas of collaboration.

The results of this

strategic partnership:

Reduced transaction latency from 30 to 13 seconds.

Reduced development time for initial app release from 8 months to 3 months.

Achieved an 88% increase in new customer adoption in the 2nd quarter of 2023.

Maintained transaction error rate below 0.1%.

Curious about how Luby can improve your business? Talk to our specialists for valuable insights.

Client Review

“Luby has been a critical technology partner in Tiba’s growth, helping us develop our key solutions that we have brought to market. We highly recommend Luby to companies looking for a technology partner for any type of requirement”.

Thiago Pires (Product Lead)

Skill Set

Software Architecture

Solutions Architecture

Front-end Development

Back-end Development

Mobile Development

Quality Assurance

Product Management

Product Owner

Scrum Master

Tech & Stack

About the company

Tiba is a technology company founded in 2021 with the goal of revolutionizing the relationship between small retail businesses and business management. We offer a comprehensive and affordable management solution.

Start Accelerating your Digital Roadmap Today!

Just fill in this form our call us at +1 (305) 600 1993

Technology Intelligence

Luby - North America

1110 Brickell Avenue

Suite 310

Miami – FL

United States

Phone:

Email:

Luby - Latin America

Rua Amália de Noronha, nº 151, 3º Andar, Sala 303

Pinheiros, São Paulo – SP – Brasil

CEP: 05410-010

Pinheiros, São Paulo – SP – Brasil

CEP: 05410-010

Phone:

Email:

Copyright ©2023 Luby Software LLC. All rights reserved.