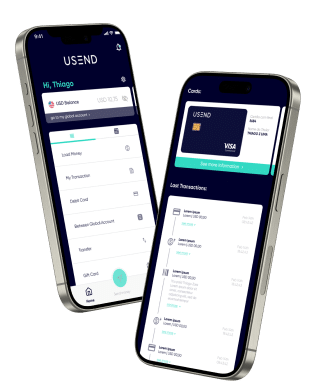

usend case study

Cutting-edge solution for cross-border payments

The Usend Challenge

Pontual Money Transfer Group has embarked on a mission to address the challenges immigrants face in international money transfers, with the goal of becoming a leading company facilitating transactions between the US, Canada, and Brazil.

In 2018, the company launched USEND, a remittance platform, with Luby serving as its technology partner throughout the development process.

In 2018, the company launched USEND, a remittance platform, with Luby serving as its technology partner throughout the development process.

The Luby solutions integrated into this project:

Financial Innovation

95% of international money transfers in the US were done manually through partner agents. Luby’s main challenge was to support the creation of a platform that would digitize this operation and bring more agility and accessibility to this service: USEND.

In order to develop this solution, we started our work with an initial discovery phase. In this phase, our task was to:

In order to develop this solution, we started our work with an initial discovery phase. In this phase, our task was to:

- Design the product roadmap based on what was most important to the customers;

- Outline strategies for developing the initial MVP;

- Assess the technical feasibility and cost of the project;

- Define the time, team, and resource requirements for development.

Banking Evolution

With the initial solution validated and its performance proven, our team grew and we began a new phase of the project, focusing on the evolution of the platform.Following a methodology of continuous and incremental delivery, our team worked to ensure that the product evolved rapidly.

Our team was made up of different profiles such as: backend development, mobile development, UX and also a PO to lead the project.

In order for the product to evolve assertively, we worked with the client to:

Our team was made up of different profiles such as: backend development, mobile development, UX and also a PO to lead the project.

In order for the product to evolve assertively, we worked with the client to:

- Assess market needs through benchmarking;

- Gather feedback from the public and identify opportunities for improvement.

- International transfers to more countries.

- Digital account for customers.

- A debit card for international transactions.

CyberSafe

This solution focuses on the adoption and implementation of anti-fraud tools and security policies, with a multidisciplinary team working on all aspects of a cybersecurity project.

Our team, made up of different technology profiles, worked on the study, definition and integration of the LexisNexis ThreatMetrix tool, which acts as digital identity and authentication intelligence to prevent fraud in the system and enable the adoption of AML policies and KYC measures. The result was a secure platform that meets global fraud and anti-money laundering metrics and policies.

Our team, made up of different technology profiles, worked on the study, definition and integration of the LexisNexis ThreatMetrix tool, which acts as digital identity and authentication intelligence to prevent fraud in the system and enable the adoption of AML policies and KYC measures. The result was a secure platform that meets global fraud and anti-money laundering metrics and policies.

Data Analytics

Making the most of the data was also a concern, as we knew that the financial transactions USEND processed could provide valuable insights and support strategic decisions. Our team’s work included:

- Developing a custom BI for the USEND product using Javascript, which provided a dashboard that consolidated information from the product’s database and transformed this information into performance metrics.

- In addition to the USEND product, our DataMinds solution helped the client create an external data pipeline. This BI platform, developed in Java, consolidated information on rates charged by the international remittance market from multiple sources and databases. The result was a better understanding of competitor pricing.

Payment Solutions

Concerned with solving its customers’ main pain points, the Group needed to enable payment transactions through its USEND platform. With a team of backend developers, specialists in integrating payment methods, we worked on:

- Studying, defining the flow and implementing direct integration with a Brazilian bank, responsible for validating, issuing and settling bills and remitting money to Brazil.

- The aim of this integration was to allow bills to be paid via the USEND platform. This demand arose from feedback from Brazilian users themselves.

- Study, definition and implementation of integration with the international payment system Paykii, belonging to the Tribal Group, responsible for managing payments to countries in Europe and Asia.

CustomerX

Improving the user experience and fostering a good relationship was also a challenge as USEND had to serve customers from different countries, languages and cultures. With this in mind, we actively researched and implemented the Zendesk relationship platform, which provides a complete customer service solution that can keep pace with USEND’s growth.

The results of this

strategic partnership:

+ 150,000 customers in the first year.

+ 13 million users with access to the product.

40+ countries benefit from the solution.

Leader in shipments to Latin America and the United States.

Wondering how Luby can benefit your business? Connect with our specialists to gain valuable insights.

Client Review

“Luby is an innovative company that is committed to its projects. They have highly skilled developers who are able to meet the needs of their customers. I’m very happy to have Luby as a working partner. I feel confident to carry out the most challenging tasks”.

Wilson Baraban Filho (CTO)

Skill Set

Front-end Development

Back-end Development

Mobile iOS & Android Development

UX/UI Design

Data Analyst

Solution Architect

Tech & Stack

About the company

In 2016, Pontual Money Transfer Group was responsible for 25% of all remittances sent by immigrants to Brazil, and has since expanded its services to other countries.

The remittance platform USEND, developed in partnership with Luby, was acquired by Banco Inter in 2022. An important part of the bank’s internationalization strategies, USEND is now integrated into its services and applications and is widely used by its portfolio of national and international clients.

The remittance platform USEND, developed in partnership with Luby, was acquired by Banco Inter in 2022. An important part of the bank’s internationalization strategies, USEND is now integrated into its services and applications and is widely used by its portfolio of national and international clients.

Start Accelerating your Digital Roadmap Today!

Just fill in this form our call us at +1 (305) 600 1993

Technology Intelligence

Luby - North America

1110 Brickell Avenue

Suite 310

Miami – FL

United States

Phone:

Email:

Luby - Latin America

Rua Amália de Noronha, nº 151, 3º Andar, Sala 303

Pinheiros, São Paulo – SP – Brasil

CEP: 05410-010

Pinheiros, São Paulo – SP – Brasil

CEP: 05410-010

Phone:

Email:

Copyright ©2023 Luby Software LLC. All rights reserved.