Strategic operational models for maximizing GenAI in financial services

26 de September de 2024

26 de September de 2024

Generative artificial intelligence (GenAI) is transforming the banking sector, bringing new opportunities for innovation and efficiency. With the promise of adding between 200 and 340 billion dollars to the annual value of the global industry, the strategic implementation of this technology could transform the way banks and financial institutions operate.

However, choosing the right operating model is critical to making the most of this technology. In this article, we’ll explore the best practices for selecting and implementing the ideal Generative AI operating model for your business.

An operating model refers to the way a company structures and manages the integration of technology into its operations. The choice of this model is crucial, as it directly affects the efficiency and success of the implementation of Generative AI. A well-selected model can guarantee:

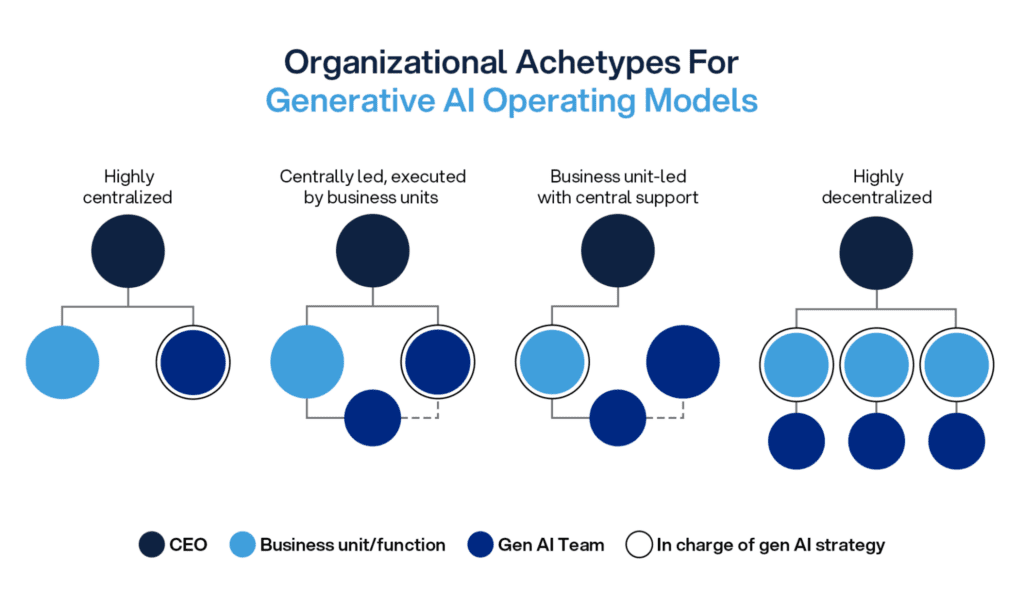

The model adopted by a business can vary from a centralized approach, where one department controls Generative AI, to a fully decentralized model, in which different areas of the company have the autonomy to do so.

Highly centralized model: In this model, the management and coordination of Generative AI is centralized in a specific team, offering control and consistency. This approach allows for the uniform development of skills and the definition of clear guidelines. However, there can be a disconnect with the business units, which can make it difficult to integrate the technology with the specific needs of each area.

Centrally led model, executed by business units: Here, the centralized GenAI team leads strategy and development, while the business units are responsible for executing the solutions. This model facilitates integration and support throughout the company, promoting closer collaboration between the parties involved. However, the need for approval from the business units can result in delays in implementing the technology.

Business unit-led model with central support: In this model, the business units lead the implementation of Generative AI with centralized support for resources and guidelines. This facilitates the adoption of the technology and aligns the solutions to local needs. However, coordination between different units can be challenging, and there can be variations in the development and application of the technology between the different areas.

Highly decentralized model: Each business unit or department is responsible for its own Generative AI initiatives. This model offers great flexibility and customization, allowing each area to adapt the technology to its specific needs. However, there can be challenges related to integration and coordination between the different systems and processes, as well as a possible lack of access to best practices and centralized knowledge.

Each approach has different benefits and challenges. However, in the financial sector, most institutions prefer a centralized model, as studies show that 70% of companies that have adopted this model have advanced in their use of technology, compared to only 30% of those that have opted for a fully decentralized model.

Choosing and implementing a Generative AI operating model for banks and fintech requires a careful analysis of several areas, taking into account internal and external aspects, such as:

To maximize the potential of this technology, financial institutions must consider the pace of innovation, their organizational culture, and the evolving regulatory environment. Adaptive decisions are essential to unlock new opportunities while facing the challenges of adopting emerging technologies.

Success depends on continuous learning, strategic adaptation, and a well-defined operating model. Companies like Luby, with extensive experience in financial software, help implement robust Generative AI solutions, ensuring sustainable results over the long term.