The transformation of financial services with hyper-personalization

4 de December de 2024

4 de December de 2024

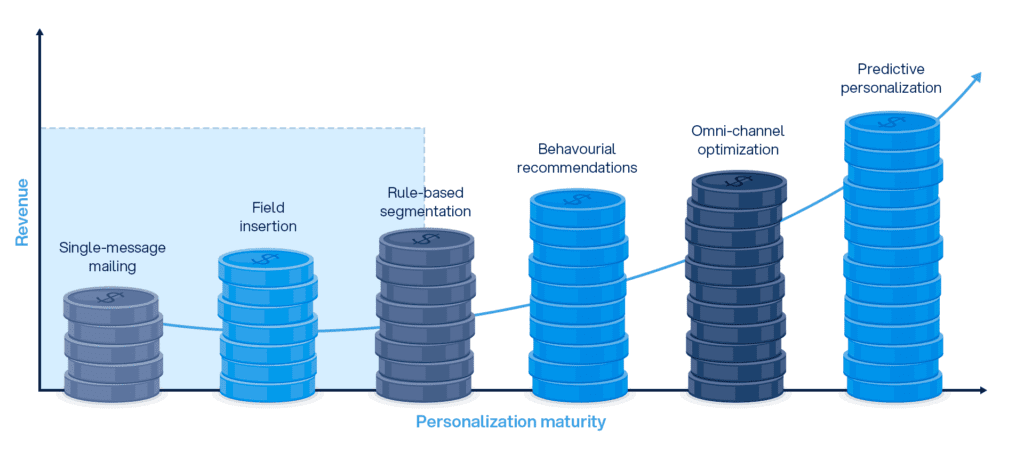

Hyper-personalization in the financial sector has become one of the main strategies for banks and financial institutions all over the world to enhance the customer experience to a higher standard. By combining technology with a customer-centric approach, banks are creating experiences tailored to the individual needs of each user, raising the level of engagement and increasing customer retention. With increased competition in the sector, the adoption of tools such as artificial intelligence (AI), big data, and machine learning has become essential for those who want to stand out in the market.

Hyper-personalization goes beyond traditional personalization. Instead of simply using the customer’s name in communications or making generic recommendations based on previous purchases, it leverages real-time data and machine learning to provide offers and services that precisely align with each customer’s needs.

In the banking context, this can mean offering specific loans at exactly the right time, adjusting credit limits automatically based on the customer’s financial behaviors and even predicting the need for service before the customer realizes it.

The main factor enabling the implementation of hyper-personalization in the financial sector, through tools such as:

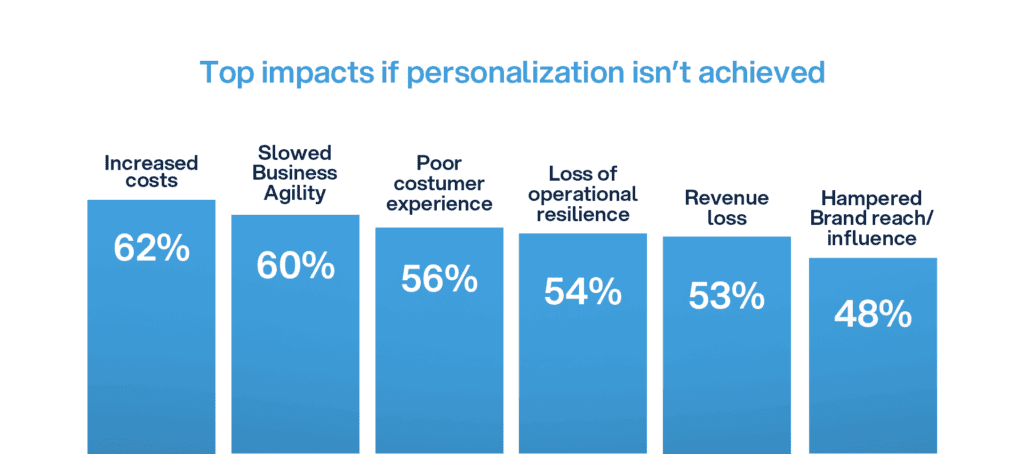

Although the technology that supports hyper-personalization is advanced, many financial institutions face barriers to implementation. Legacy systems and a lack of integration between platforms make the process challenging. For example, many banks still operate with old infrastructure that doesn’t support the real-time processing required for hyper-personalization. In addition, the integration of channels and data from different sources, such as mobile apps, physical branches, and telephone answering services, requires investment in flexible and modern architectures.

Another sticking point is the issue of privacy and data protection. In an environment where regulations, such as the GDPR in Europe and the LGPD in Brazil, are increasingly strict, institutions need to ensure that the collection and use of personal data is done securely and transparently, without compromising customer trust. The adoption of solid data governance and regulatory compliance practices becomes a crucial aspect of the success of hyper-personalization.

The financial sector has already realized the value of personalization in providing services and experiences. With the use of analytical data and innovative technologies, financial institutions are developing personalized solutions that meet the unique needs of each customer, promoting deeper engagement and enriching the user experience. Below, we’ll explore some use cases that not only increase customer satisfaction but also strengthen brand loyalty in an increasingly competitive market.

Creating a fluid journey between digital and physical channels is one of the greatest benefits of hyper-personalization. Financial institutions that adopt this approach ensure that the customer has a consistent experience, whether on the app, website, or physical branch.

Bank of America is an example of an omnichannel experience, allowing customers to perform tasks such as depositing checks and scheduling appointments through mobile and desktop applications.

Banks are increasingly investing in technologies that use real-time data to offer products and services at the exact moment when they are most relevant to the customer. Instead of receiving generic offers, customers benefit from personalized recommendations.

In Europe, BBVA offers financial solutions that automatically adjust based on spending profiles and suggest new banking products based on previous transactions.

Personalization is also present in financial security. With behavioral analysis, machine learning, and big data, banks identify suspicious patterns and take action before fraud occurs. This process is based on creating a unique profile for each customer, making it easier to detect anomalous activity.

HSBC, for example, has implemented a fraud detection solution that, by understanding individual customer behavior, provides a proactive response to threats, preventing losses.

Process automation is an area where hyper-personalization is having a substantial impact. By using AI and predictive analytics, banks offer financial recommendations tailored to each customer’s risk profile. This includes adjusting credit limits and suggesting investment products that maximize returns.

XP Investimentos, for example, uses customer data to personalize investment offers, adjusting them according to individual profiles and goals. JPMorgan Chase, on the other hand, uses AI to monitor behavior and suggest credit and savings solutions according to the client’s objectives.

The hyper-personalization strategy, although strongly adopted by the financial sector, is also revolutionizing other industries. In retail, for example, big players like Amazon use machine learning algorithms to suggest products in real-time based on users’ shopping and browsing behavior, increasing conversion and satisfaction. In the health sector, hyper-personalization is being used to offer customized medical treatments based on genetic data and the patient’s health history, creating a more precise and efficient care experience. This shows that the possibilities of hyper-personalization are vast and that, with the evolution of technologies, its impact can be felt in almost every area of daily life.

Hyper-personalization is already transforming the way banks operate, but the potential of this strategy is only just beginning to be exploited. Financial institutions that adopt these technologies not only meet their customers’ current needs but also anticipate the future of the sector.

By leveraging AI, big data, and machine learning, they will be able to offer more integrated, secure, and customer-centric solutions, securing their place as leaders in the future of the financial sector.