Technological innovation has transformed the financial sector in surprising ways. Among the most notable changes is the emergence of Decentralized Finance (DeFi) and Decentralized Banking, which are not only offering new opportunities but also challenging the traditional financial system.

Aimed at democratizing access to financial services, DeFi has the potential to transform the way we deal with loans, investments, and asset trading. They are gaining prominence in global markets, including the US, by enabling direct transactions between users, without relying on intermediaries such as banks and brokers.

DeFi refers to an ecosystem of financial services that operate on blockchains, using cryptocurrencies and smart contracts. Unlike the traditional financial system, which relies on banks and centralized financial institutions, DeFi allows transactions directly between users, with total transparency and security, without the need for a central authority.

These self-executing contracts are stored on the blockchain, which ensures that once the agreed conditions are met, execution takes place automatically. This is especially attractive for those looking for more privacy and lower fees in their financial transactions.

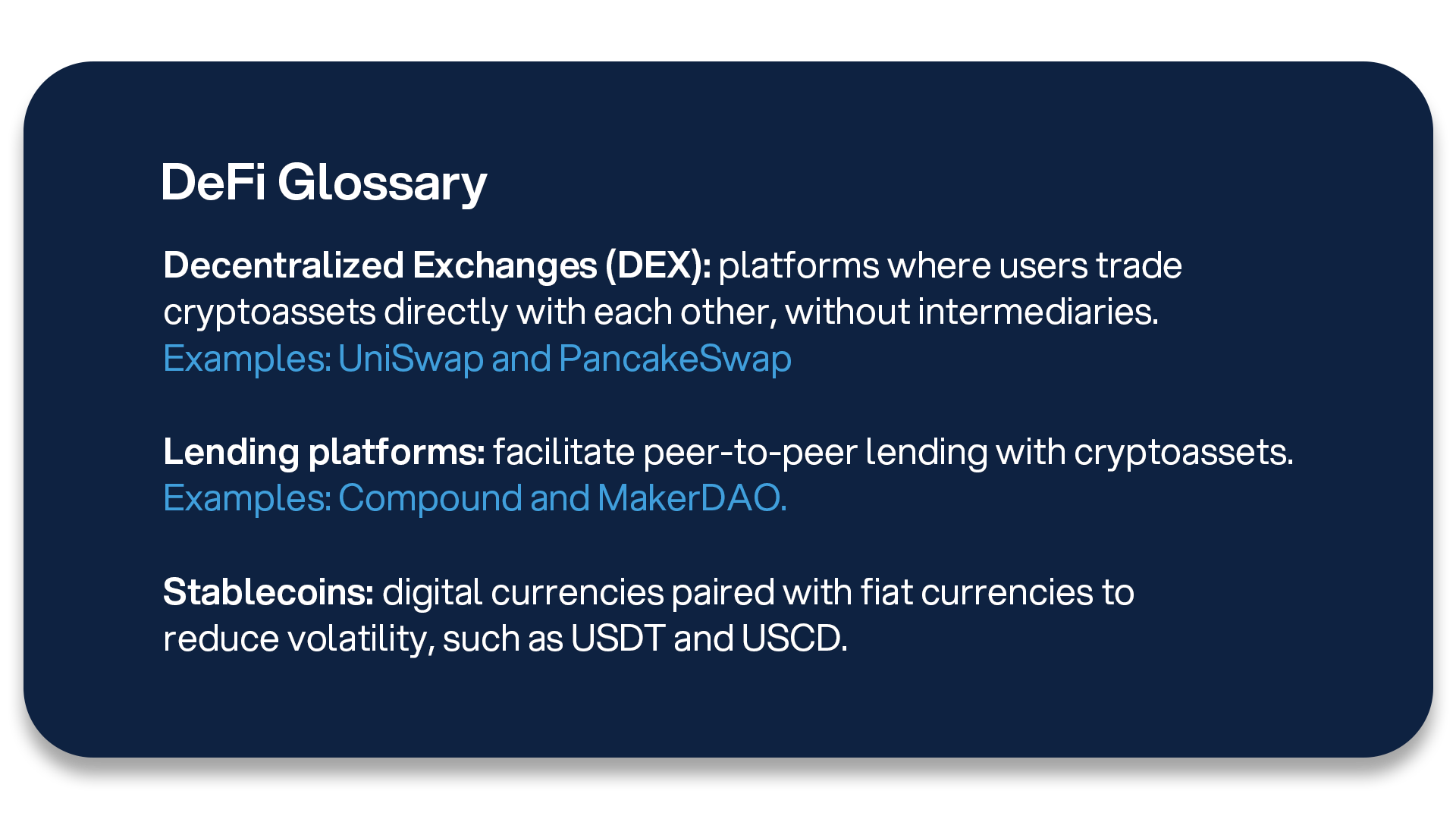

DeFi is revolutionizing the financial sector by offering fast, accessible, and transparent alternatives to traditional services. Some of the main features that stand out are:

The DeFi regulatory landscape is evolving rapidly around the world, with different countries seeking to balance innovation and financial security. In the US, the SEC (Securities and Exchange Commission) is monitoring DeFi platforms, suggesting that many of them could be treated as securities, which would imply compliance with traditional regulations. In addition, the US Treasury is on the lookout for risks such as money laundering and terrorist financing, requiring measures such as “Know Your Customer” (KYC) on DeFi platforms.

In the European Union, MiCA (Markets in Crypto-Assets) is being implemented to regulate crypto-assets and DeFi platforms, promoting greater transparency and consumer protection, while DORA addresses cyber risks. On the other hand, countries like Singapore are taking a more flexible approach, allowing innovation while maintaining AML/CFT (Anti-Money Laundering and Combating the Financing of Terrorism) regulations. China and other nations have restricted or banned DeFi activity, concerned about financial stability.

Among the main advantages of DeFi are:

Risks, on the other hand, include:

Platforms such as Aave and Uniswap are gaining popularity. On Aave, users can lend crypto-assets and earn interest without relying on traditional banks. On Uniswap, crypto trading takes place directly between users, eliminating brokerage fees and providing greater autonomy.

These platforms have generated above-average returns compared to traditional financial products such as savings accounts and investment funds.

Scalability remains one of the biggest obstacles to DeFi’s growth. As more users join the ecosystem, the demand for transactions grows, which can overload blockchain networks. This results in higher fees and longer confirmation times. To solve this, solutions such as Layer 2 blockchains are being developed, but scalability remains a significant challenge.

In addition, the decentralized nature of DeFi and the use of smart contracts create vulnerabilities that can be exploited by hackers. The misuse of “admin keys” – governance keys that allow a small group of people to change the platform’s parameters – also threatens the complete decentralization of DeFi, making it more susceptible to manipulation or failure.

These challenges drive constant innovation in the sector, with teams of developers focused on improving the security and increasing the efficiency of DeFi platforms.

Although DeFi is still at an early stage, its transformative potential in the financial system is undeniable. In time, as regulatory and security issues are resolved, DeFi could be widely integrated into the global financial system, offering new avenues for access to capital and innovation.

If you are interested in exploring how Luby’s technology solutions can help your company seize the opportunities of Decentralized Finance, fill out our form and get in touch with our team. We’re ready to help you navigate this new world of decentralized finance.