Strengthening Cartos' position as a pioneer in Banking as a Service

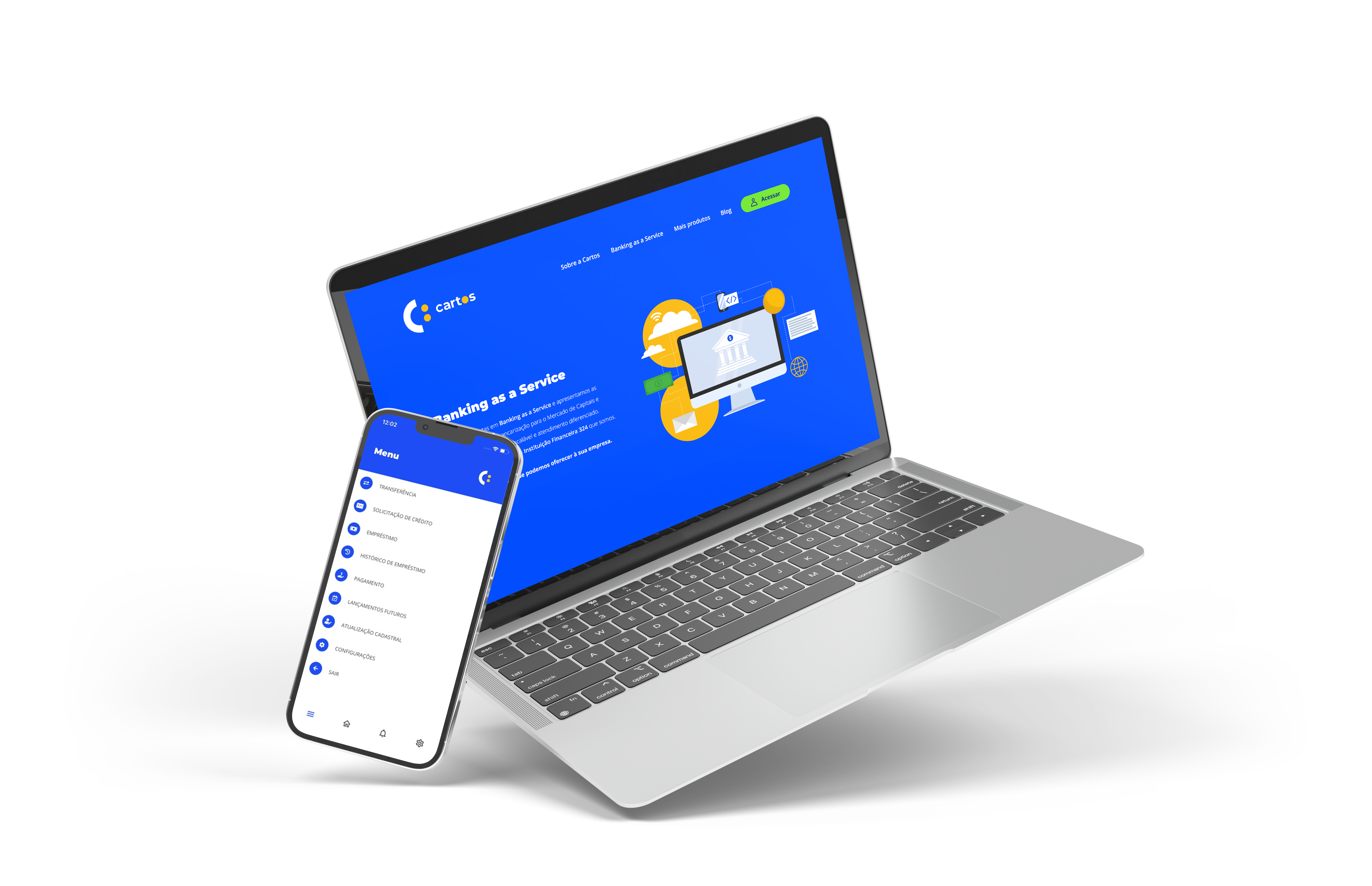

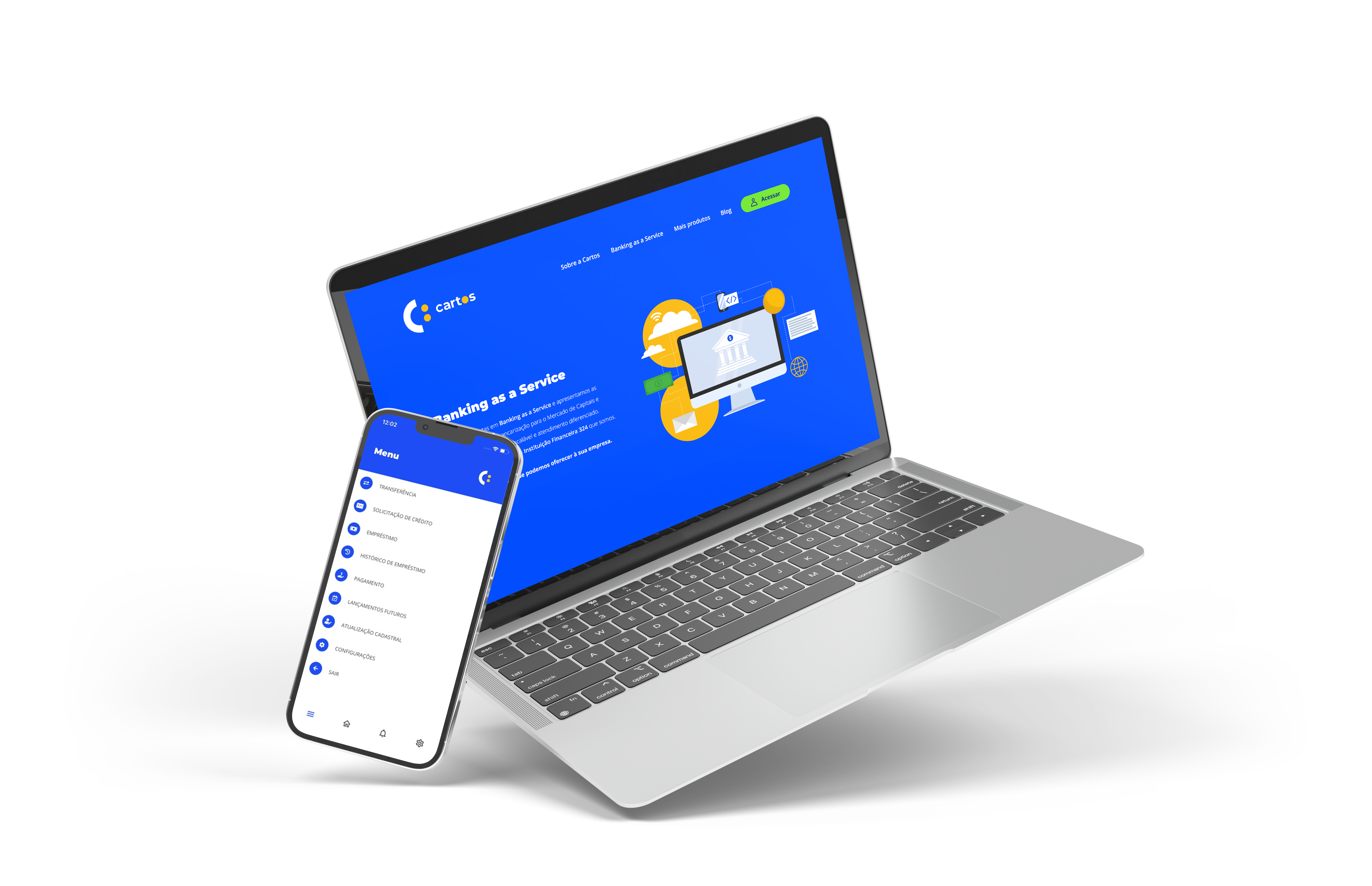

With more than 13 years of experience, Cartos specializes in Banking as a Service (BaaS). Authorized by the Brazilian Central Bank in 2019, it has overcome challenges to democratize access to credit through high-quality, secure financial services. In partnership with Luby, Cartos enhanced its products and implemented innovative BaaS solutions.

After receiving its financial institution license, Cartos faced challenges in adapting to its new business. Initially partnering with another provider, it switched to Luby to find a partner that could raise product standards and overcome obstacles.

We evaluated the existing application and rebuilt it from the ground up. Following a clear roadmap, we formed four multi-disciplinary teams to develop a scalable, highly available, fault-tolerant architecture using AWS serverless and microservices.

SPB

Brazilian Payment System

SPI

Instant Payment System

PSTI

IT Service Provider System

The app included core Internet banking features such as TEDs, providing a secure system for account opening, banking, and monitoring via mobile and web. This enabled Cartos to offer premium banking services.

Digital Account Project

With the first version validated and a strong roadmap in place, we enhanced Cartos’ core banking system and cleared the project backlog.

Building on Cartos’ robust core banking, we developed their Banking as a Service platform, a historic milestone for the company.

The platform serves credit originators (corporates, fintechs, bank correspondents) and capital market players (FIDCs, securitization firms, asset managers). With Luby’s expertise and over 20 specialists, Cartos is a BaaS leader.

We have developed a secure payment gateway with features such as inventory management, order history, customer management, and a user-friendly checkout process. This gateway integrates with payment solutions such as PagSeguro and Movingpay.

Cartos currently relies on Luby to keep its products and services up-to-date and operational. Our maintenance teams ensure process improvements, feature updates, and adaptations in response to regulatory changes or performance and security updates.

Our support teams are made up of ten professionals, including POs, solution architects, QA, and developers, who maintain existing applications while other teams focus on new requirements and technological evolution.

in transactions

operations

digital accounts

on the platform

CCBs issued

in operations without increasing staff

in new customers acquired per month

We’re the software development consultancy

that will be a game-changer

in your growth.