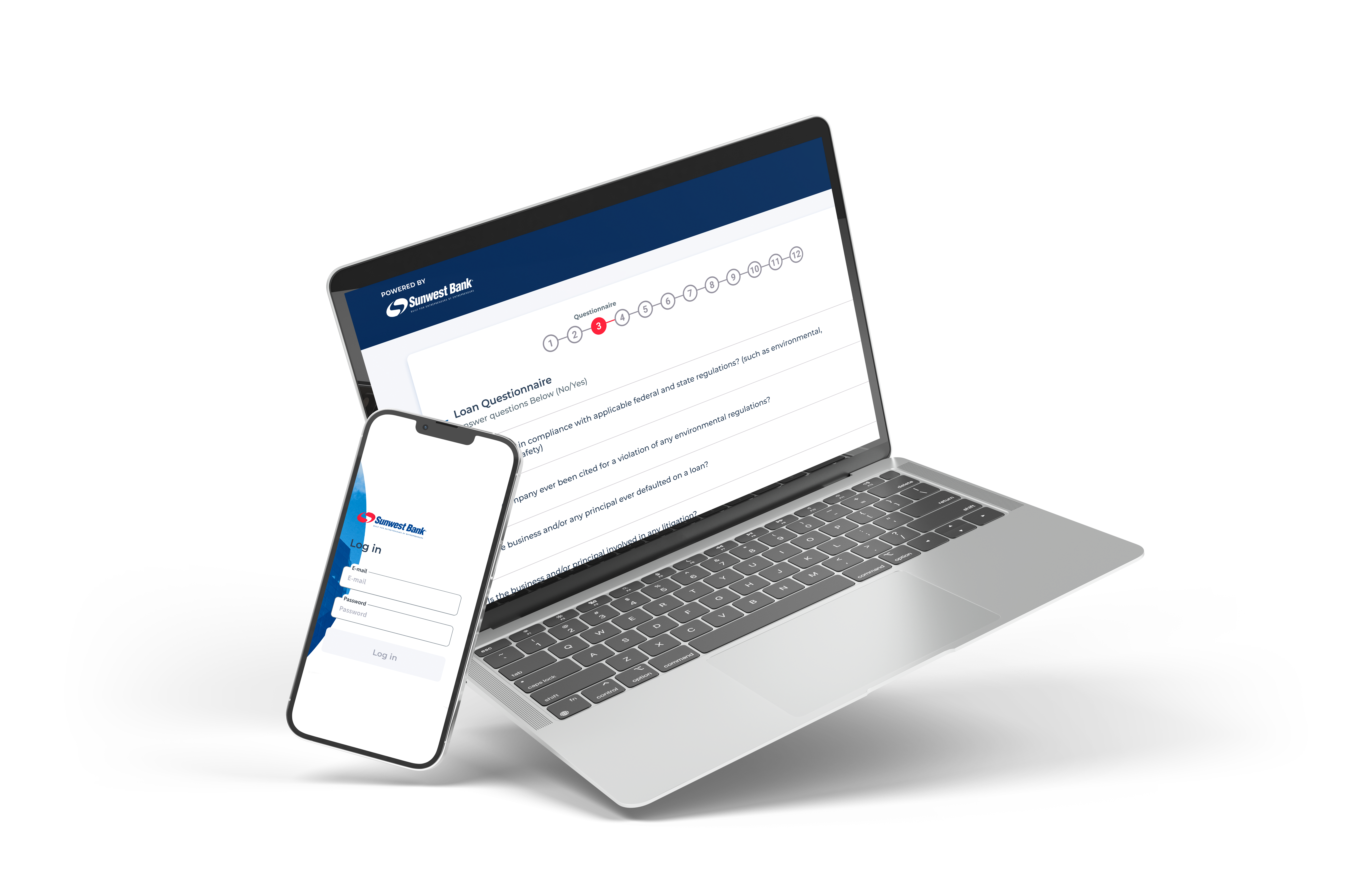

Digital Onboarding and Account Opening

Simplifying the Future of Banking

At Luby, we adopt a Design First approach to streamline the customer experience, focusing on easy, fast, and secure solutions. By working closely with customers, we create personalized journeys that simplify tasks from data collection to identity verification, ensuring a minimal-friction experience for a competitive marketplace.

Our Advantages

-

Fast account opening allows customers to access services and finish tasks quickly.

-

Advanced tools integration, like LexisNexis and IDAnalyzer, for a secure onboarding process.

-

In-depth design process resulting in smooth, pleasant user interactions and prototyping for efficiency.

-

Features to minimize manual effort, like automatic data entry and system integration, make the process faster and frictionless.

Speed

Security

Design-first Approach